In November 2024, Durham Region recorded 739 sales, a notable 39% increase from the 532 sales reported in November 2023. The average home price in the region rose slightly, from $880,089 to $904,226 during the same period.

Hastings County experienced a 13% increase in sales, with 128 transactions compared to 113 in November 2023. While sales grew, the average price saw a modest decline, dropping from $542,897 to $527,354.

In Kawartha Lakes, sales saw significant growth, with 101 transactions in November 2024 compared to 57 the previous year. The average price in the area also rose, increasing from $678,009 to $715,196.

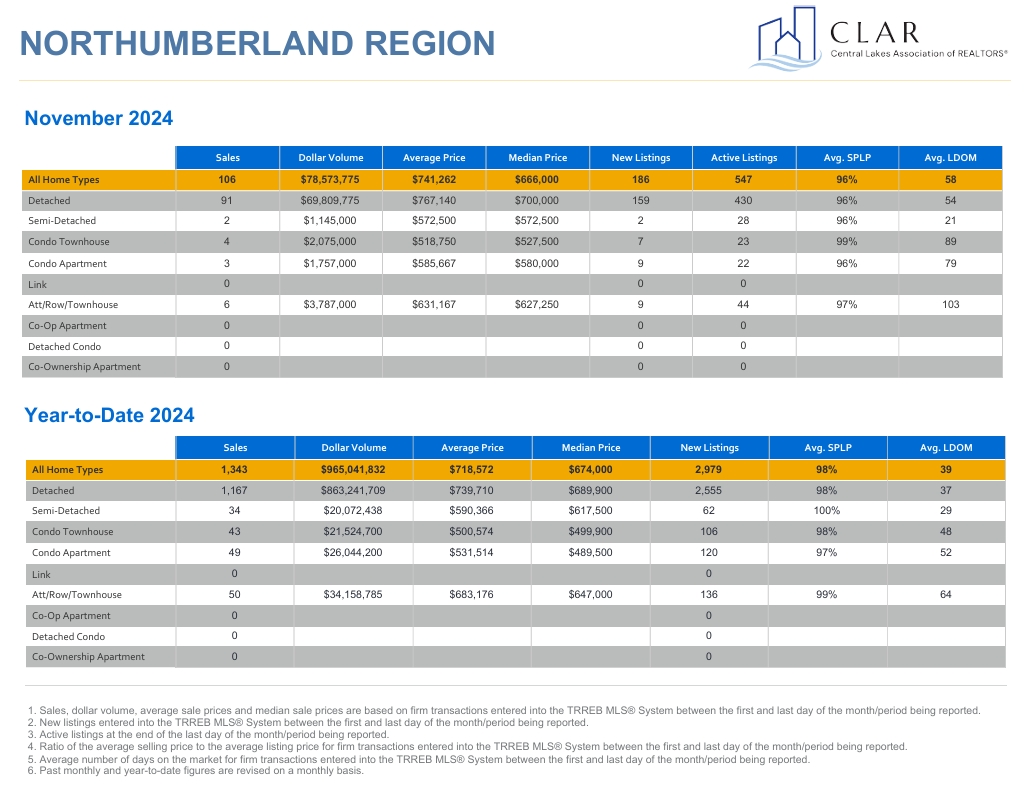

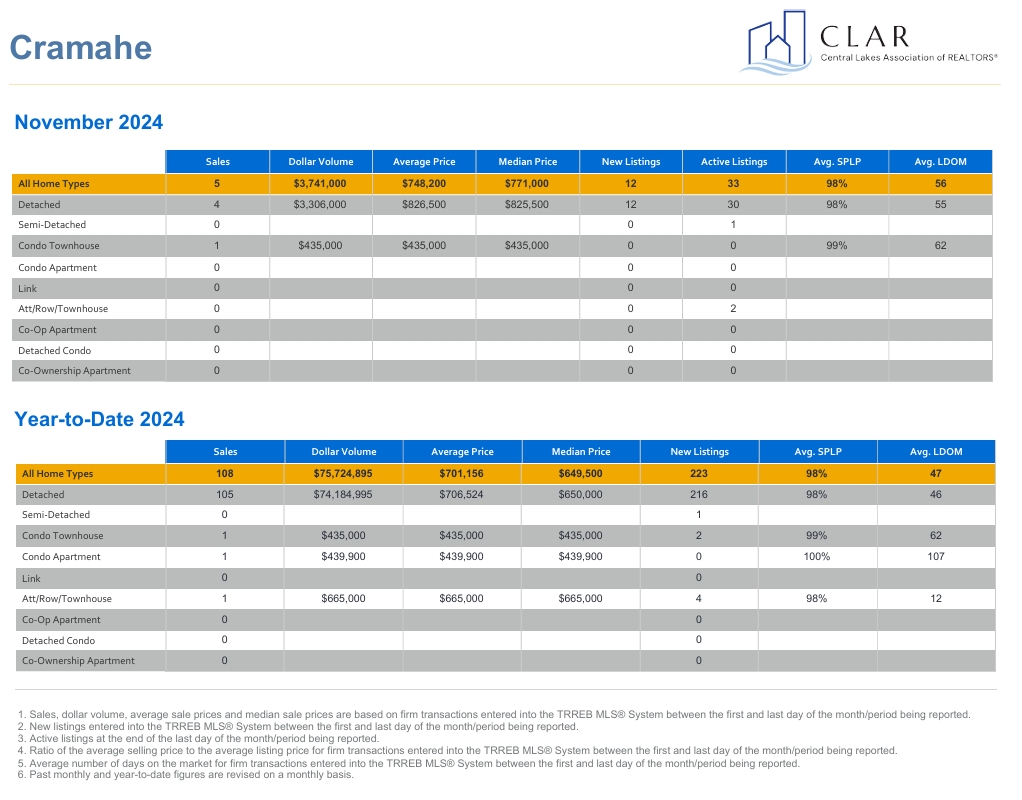

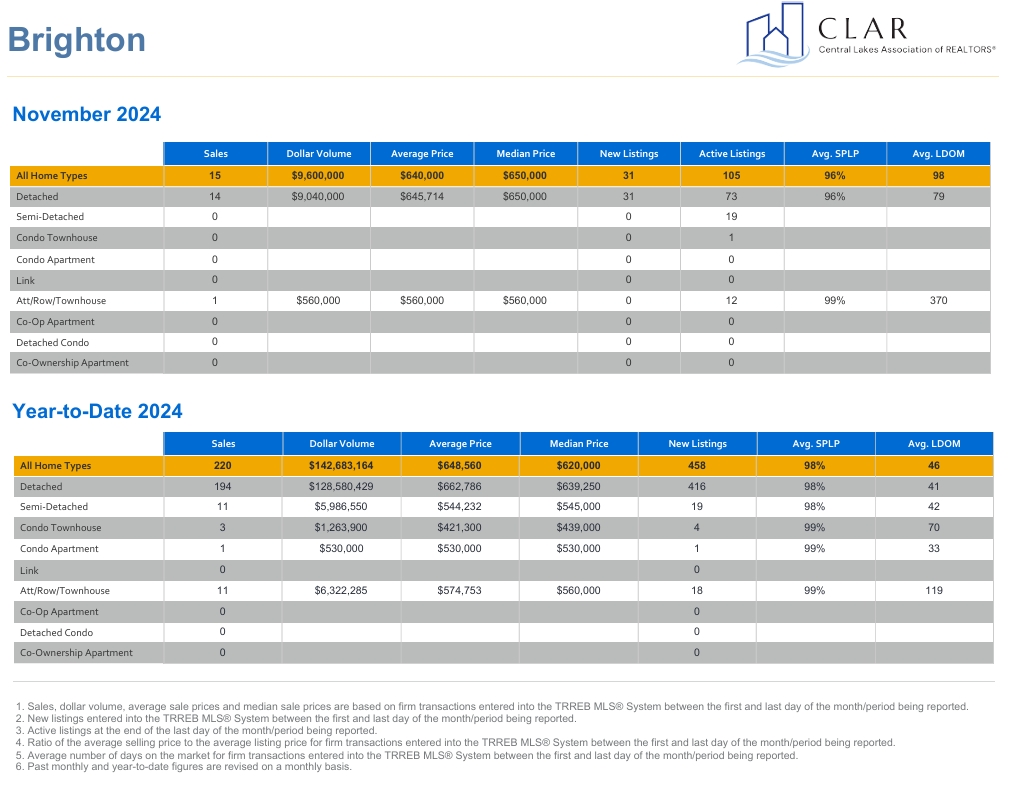

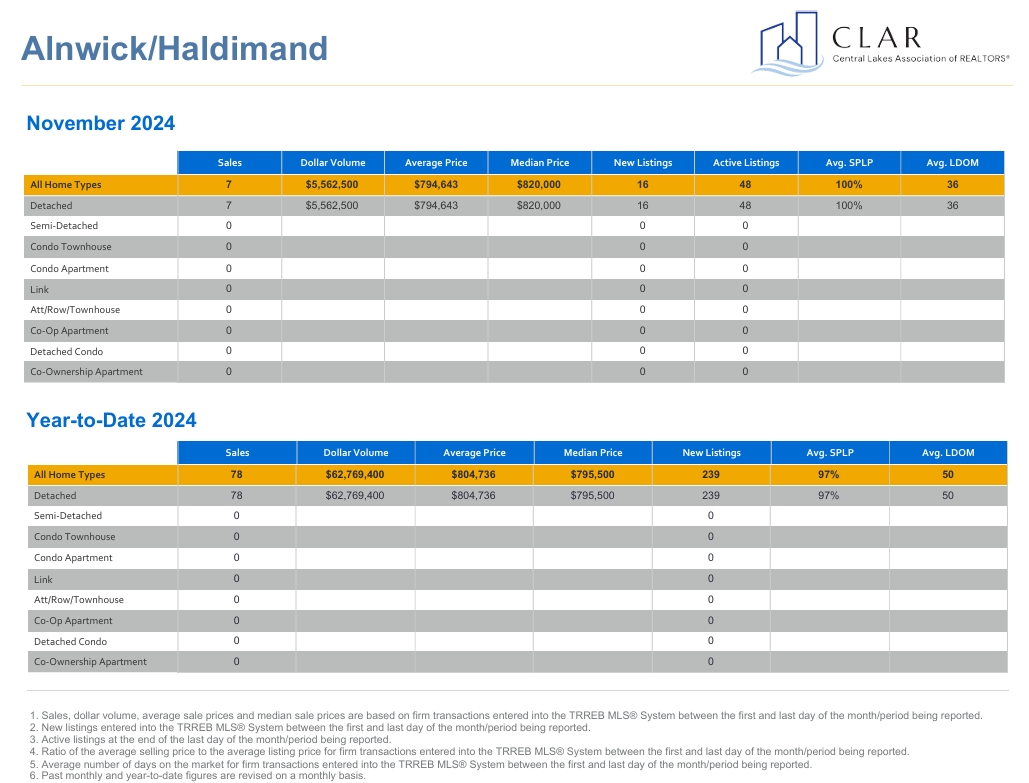

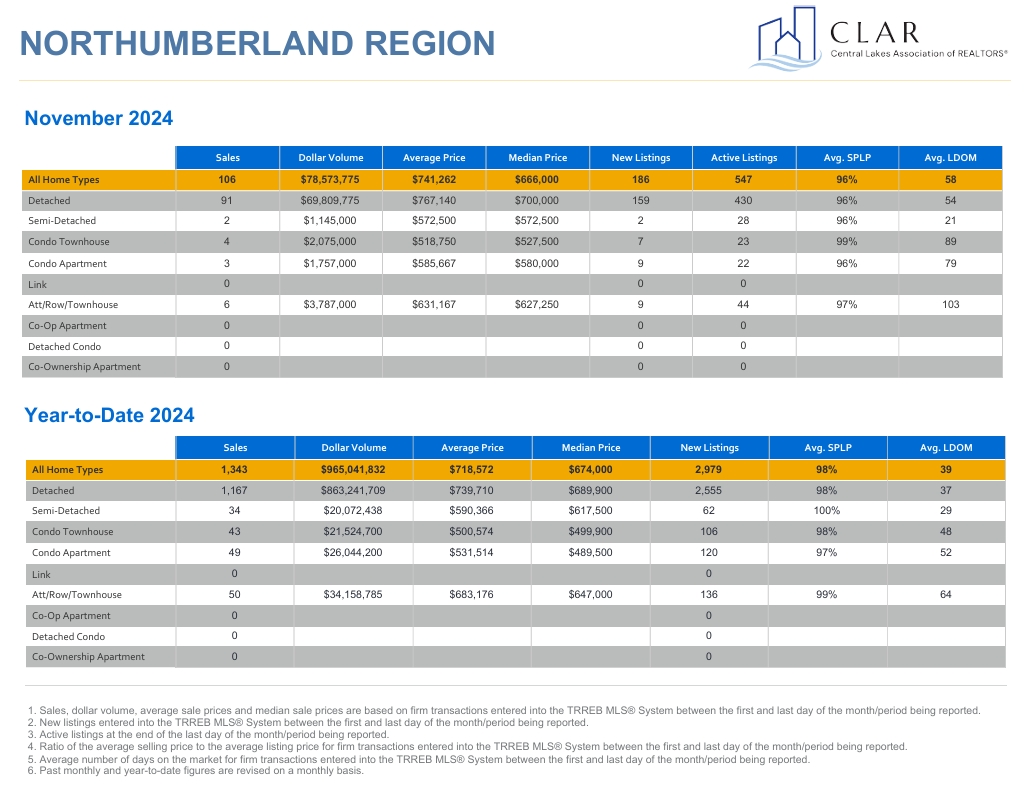

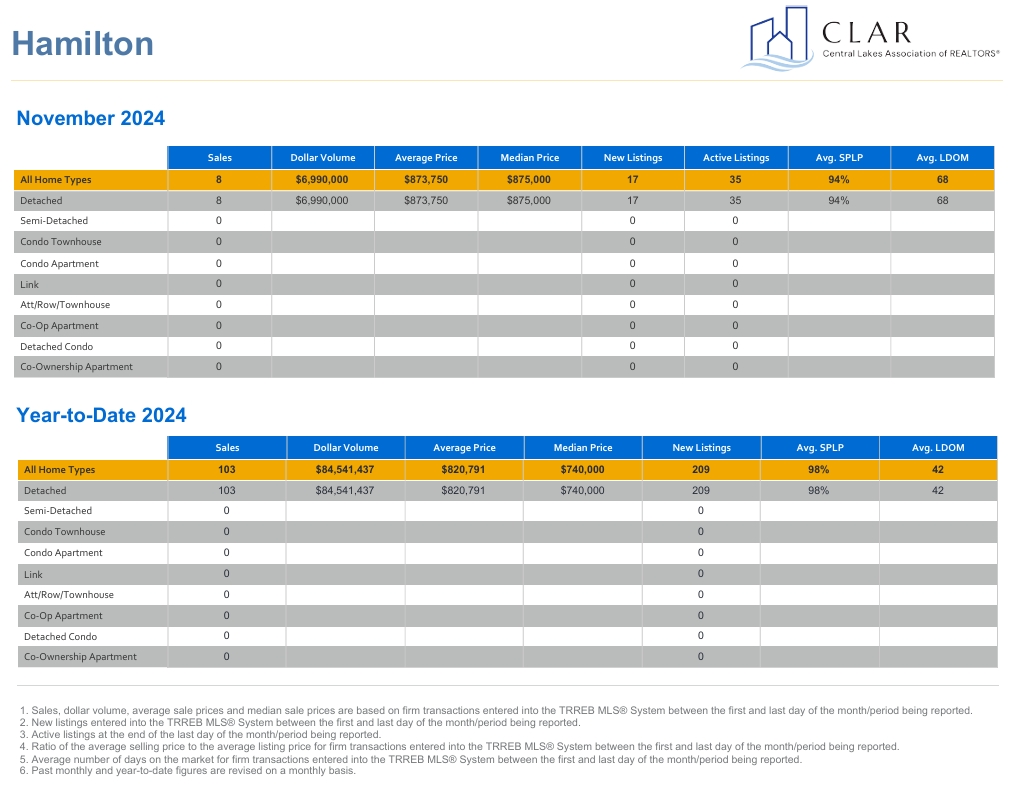

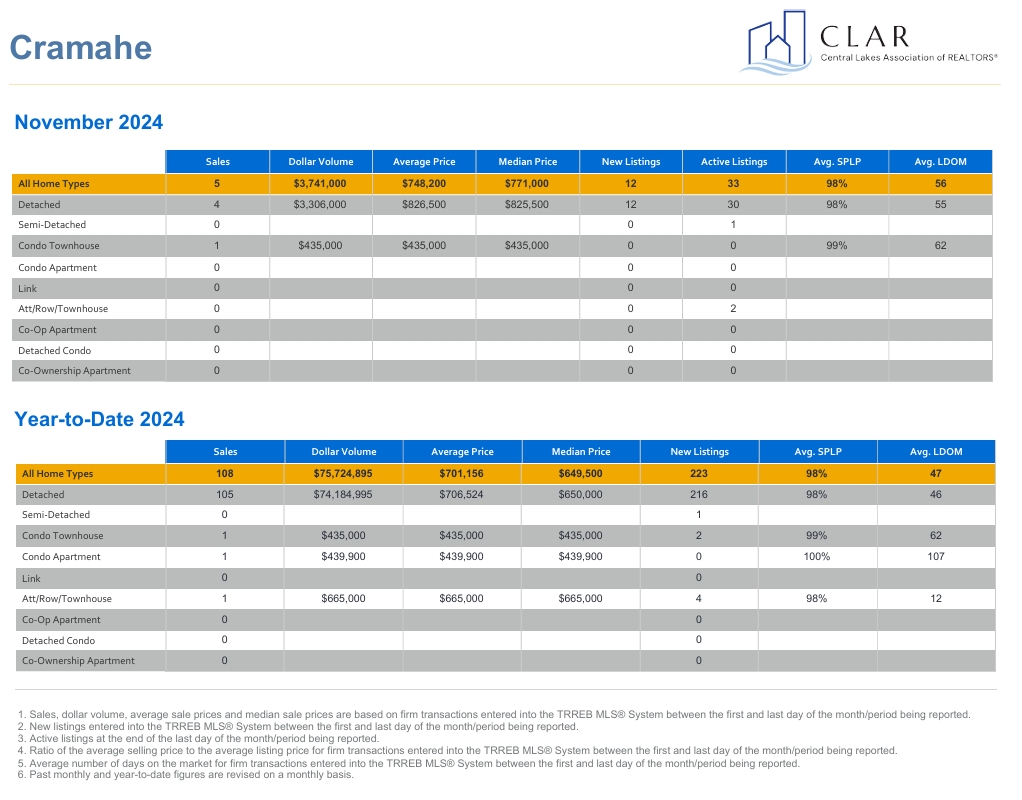

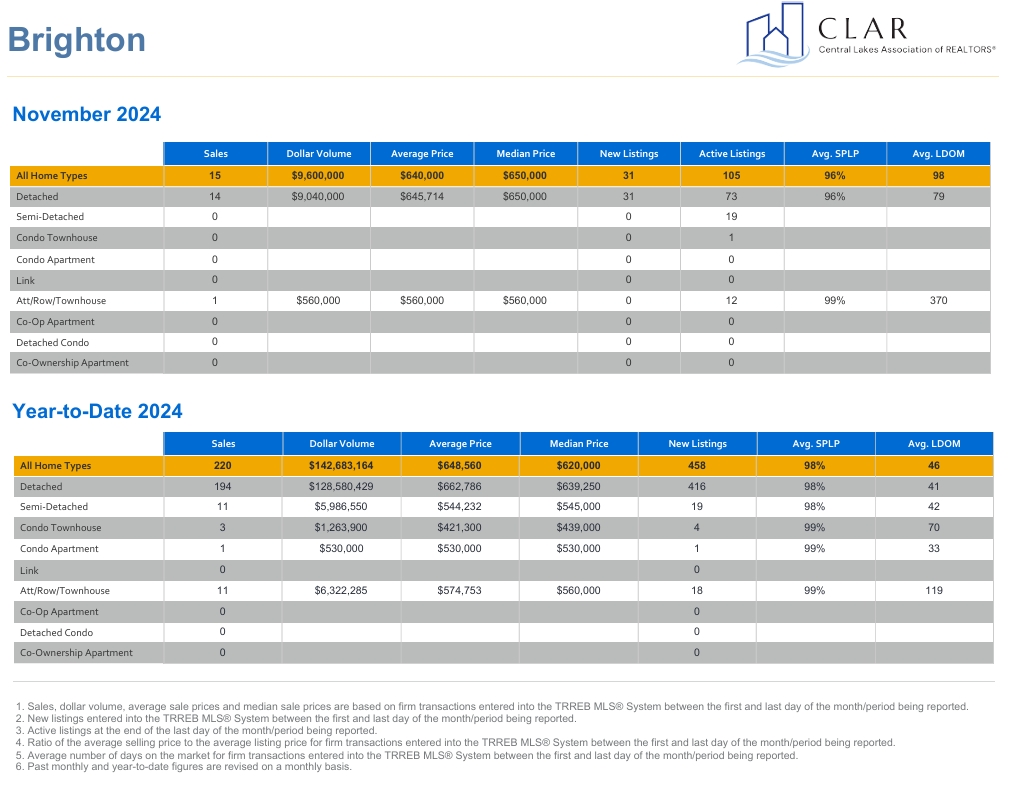

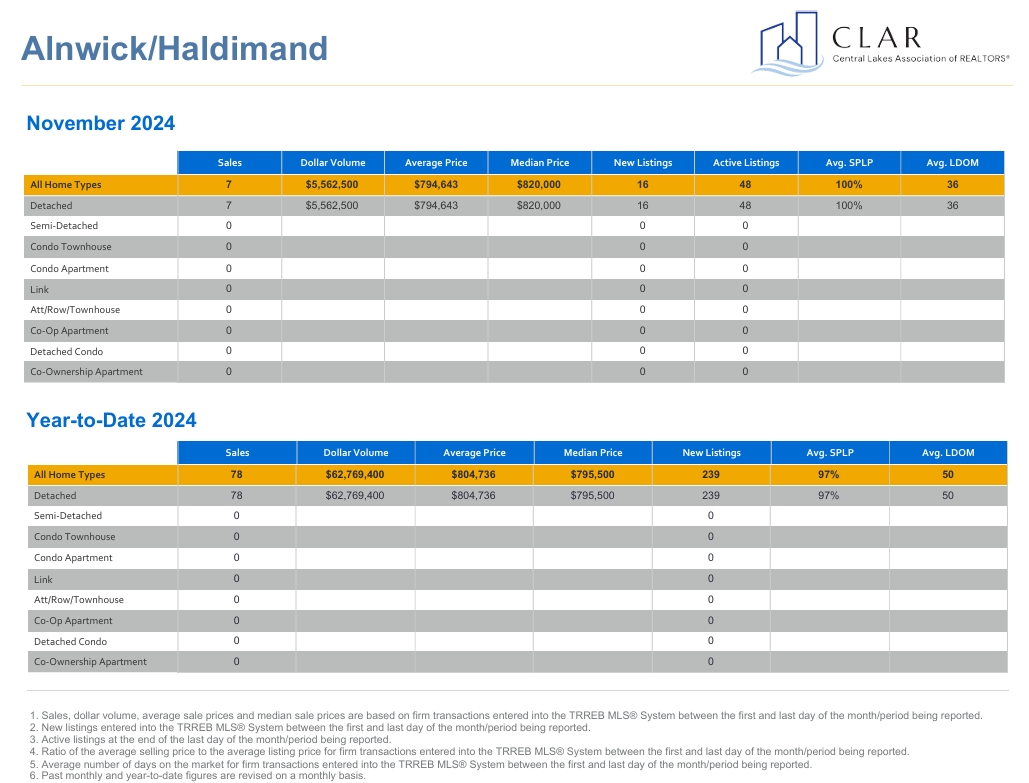

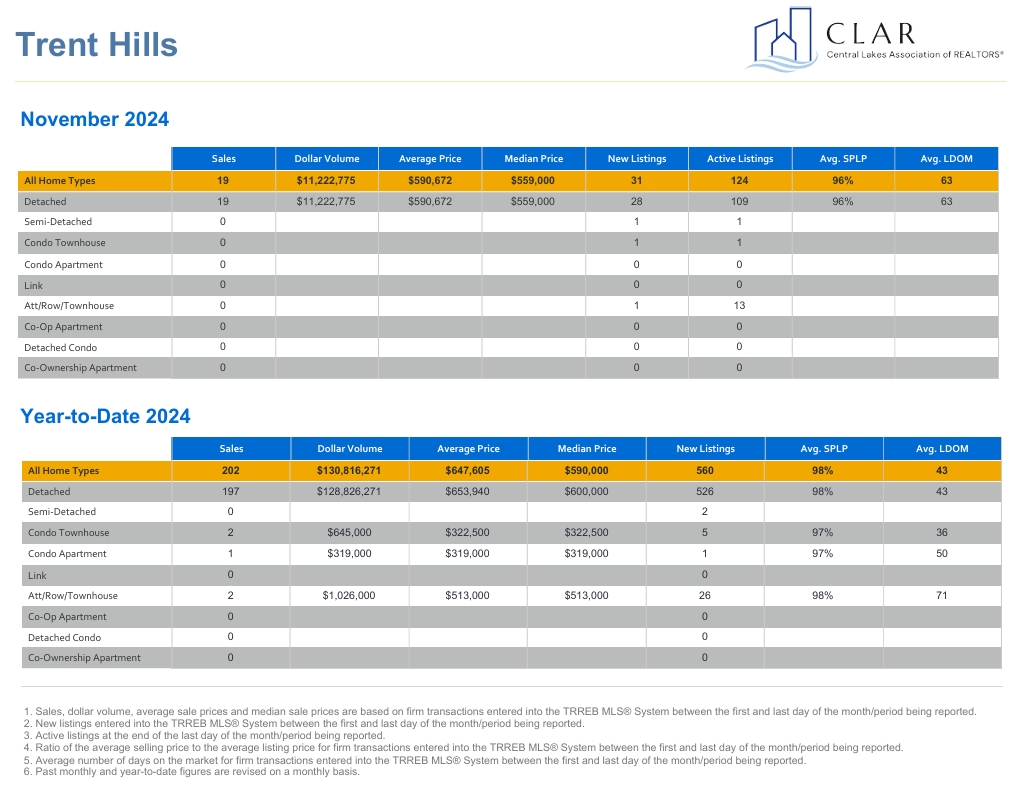

Northumberland County reported a 56% rise in sales, with 106 transactions in November 2024 compared to 68 the previous year. The average price experienced a slight dip, moving from the November 2023 average price of $753,273 to $741,262.

The Peterborough region saw a 25% increase in sales, with 125 homes sold compared to 100 in November 2023. The average price decreased by 7%, from $668,674 to $622,002.

Prince Edward County experienced a 65% increase in sales, rising from 20 in November 2023 to 33 in November 2024. At the same time, the average price decreased from $874,993 to $720,367.

CLAR Chief Executive Officer, Wendy Giroux, highlighted the organization’s commitment to supporting local communities during the holiday season. “As the holidays draw near, Central Lakes Association of

REALTORS® is proud to give back through our annual Charity Auction fundraising events. This year, we are honoured to support four local Habitat for Humanity organizations, each with active builds in our regions and community food banks. At CLAR, we believe that everyone deserves access to safe and affordable housing, and we are dedicated to making a meaningful difference by contributing to these

essential shelter-related causes.”

For more information or to book an interview, please contact: